In today’s bustling marketplace, the ability to process card payments can make or break a small business. Gone are the days when cash was king; customers now demand speed and convenience at their fingertips.

With over ten years of experience in payment technologies, We have witnessed firsthand how a reliable card reader becomes the heart of sales operations for many businesses.

Selecting the right card reader is no small feat—after all, this device is not just about taking payments but also enhancing customer experience and streamlining your daily operations.

Did you know that, as per recent reports, contactless transactions have surged by over 300% in the last few years? This piece will guide you through choosing a card reader that keeps pace with such dynamic shifts in consumer behaviour.

Discover your business’s perfect match within these lines.

Top 5 Best Card Readers for Small Business

Discover the top 5 best card readers for small businesses and find the perfect match for your payment processing needs. Learn more about how these card readers can benefit your enterprise.

TakePayments

The TakePayments is a reliable, user-friendly card reader perfect for small businesses. It offers quick and secure transactions, accepting various payment methods such as contactless cards and mobile wallets.

Its sleek design and compact size make it convenient to use anywhere in your store or on the go. The machine also has advanced security features to protect your and your customer’s sensitive information, giving you peace of mind while handling transactions.

With seamless integration into your existing systems, TakePayments ensures smooth operations for your business while providing an excellent customer experience. Its affordability makes it an ideal choice for startups or growing enterprises looking to streamline their payment processes effortlessly.

Worldpay Reader

Moving on to another reliable option, the Worldpay Reader is popular for small businesses. It offers flexibility with its mobile card reader and allows companies to accept payments anywhere.

With its straightforward setup and user-friendly interface, the Worldpay Reader makes it easy for merchants to process transactions swiftly and efficiently. The device supports various payment methods, including contactless, chip and pin, and mobile wallet payments, catering to diverse customer preferences.

Regarding security, the Worldpay Reader prioritises safeguarding sensitive payment information through advanced encryption technology, providing business owners and customers peace of mind.

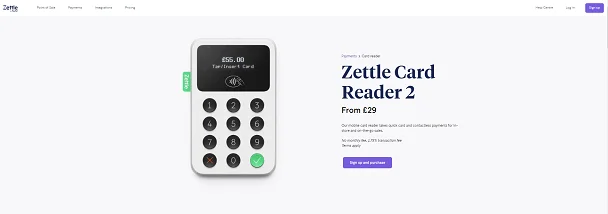

Zettle by PayPal

Zettle by PayPal is a popular choice for small businesses. It offers a mobile card reader that can be easily connected to a smartphone or tablet, making it convenient for on-the-go transactions.

With Zettle, you can accept various payment methods, including contactless cards and mobile payments like Apple Pay and Google Pay. The device is compact and easy to set up, providing a user-friendly experience for the business owner and the customers.

Additionally, Zettle by PayPal provides analytics tools that help track sales and inventory, enabling better business management.

Tyl by NatWest

Moving from Zettle by PayPal to Tyl by NatWest, another top card reader for small businesses, is worth exploring. Tyl, backed by the reputable NatWest bank, offers a user-friendly and versatile solution for processing card payments.

With Tyl, you can expect seamless integration with your point-of-sale system and quick setup for accepting various payment methods, including credit cards and contactless payments. Its competitive pricing and robust security features make it an ideal choice for small businesses looking to streamline their payment processes while ensuring customer data protection.

Square Reader

Square Reader is a popular choice for small businesses due to its simplicity and affordability. It plugs into the headphone jack of your mobile device, turning it into a card terminal.

This allows you to accept chip and PIN payments and contactless transactions, providing convenience for you and your customers.

The Square Reader also integrates with Square’s point-of-sale software, making it easy to manage sales, inventory, and customer data in one place. With transparent pricing and no monthly fees or long-term commitments, Square Reader offers an accessible option for businesses accepting card payments without breaking the bank.

What is a Card Machine?

Stepping into the world of payments, a card machine is an essential business tool. Sometimes called a card reader or point of sale (POS) terminal, it lets customers pay with their debit or credit cards.

This device can read chip & pin cards, swipe magnetic stripes, and accept contactless payments like Apple Pay and Google Pay.

A card machine connects to your bank account, so you get paid fast when someone purchases. They are small and easy to use – just tap, insert, or swipe the customer’s card. With this gadget at hand, saying goodbye to cash-only sales is simple.

Plus, you’ll look more professional, which can help grow your business!

Types of Card Machines

Mobile card readers, integrated POS systems, and contactless payment terminals are the three main types of card machines used by small businesses. Each kind offers different features and benefits to cater to varying business needs.

Mobile Card Readers

Card readers that you can take with you are perfect for small businesses on the move. They work with smartphones or tablets to let customers pay by tapping their cards or using mobile wallets like Samsung Pay and Android Pay.

These little devices connect through Bluetooth or WiFi, making them ideal for outdoor markets, pop-up shops, and service providers who visit homes.

Picking the right one means checking costs like transaction fees and whether it works with all kinds of payment methods – from debit cards to contactless. Look for card readers that are easy to use, keep your customer’s data safe (PCI compliant), and work well with other tools you might have – like apps or an online store.

Integrated POS Systems

Turning our attention to integrated POS systems, they offer more than just card reading. They combine payment processing with tools like inventory tracking and customer management in one device.

This can help business owners who want everything in one place.

These systems often include a screen where the cashier can enter items and see the total price. A printer for receipts is usually built-in, too. Many also have features to scan barcodes, making checkout faster and easier for both staff and customers.

Integrated POS systems support many types of payments – from chip and pin to mobile payments like Apple Pay or Google Pay.

Contactless Payment Terminals

Integrating POS systems in your small business can streamline operations, but contactless payment terminals bring a new level of convenience. These terminals let customers pay with a tap from their debit, credit cards, or mobile phone.

They’re quick and reduce the time each customer spends at checkout. Contactless cards, Apple Pay, and Google Pay are some methods that work well with these readers.

Small businesses benefit from contactless terminals as they meet the needs of busy shoppers who prefer to avoid entering their PIN for every transaction. They also support increased hygiene by limiting physical contact—a big plus for health-conscious consumers.

Look for features like EMV chip technology and PCI DSS compliance to ensure high security against fraud and data breaches while offering this modern payment option to your customers.

Factors to Consider When Choosing a Card Machine

Consider the price, transaction and monthly fees, accepted payment methods, features and integrations, and security measures when choosing a card machine to ensure it meets your business needs.

Price

You must pay attention to price when you’re running a small business. You want the best card reader that costs little. Look for ones with transparent pricing so there are no surprises later.

Some card readers have a low upfront cost but might charge more per transaction or have monthly fees.

It’s wise to check if the price includes customer support and security updates. These extras can save you money in the long run. Remember to compare different card readers by their complete costs over time, not just what they cost at first glance.

This way, you pick one that fits your budget and helps your business grow without breaking the bank.

Transaction and Monthly Fees

Watch out for transaction and monthly fees when picking a card reader for your small business. These costs can sneak up on you. Every time someone pays with a credit or debit card, the reader might take a small part of the sale.

This is called a transaction fee. Some companies also charge every month just to have their service known as monthly fees.

Look at different options and think about what works best for your budget. Pay-as-you-go plans might work if you still need to get lots of sales. But if you sell more, a plan with lower transaction fees but higher monthly costs could save you money.

Accepting the correct payment methods is vital, too, so let’s talk about that next!

Accepted Payment Methods

Your card reader has to handle different types of payment cards. Customers might pay with Visa, MasterCard, or American Express. Some may use Maestro or even Diners Club. You want your business to say “yes” whenever someone pulls out their wallet.

So, pick a card machine that accepts all these significant cards.

Also, think about mobile payments and online services like PayPal and Revolut. These are getting popular, too! A sound card reader lets customers tap their phone or smartwatch to pay.

This makes things fast and easy for everyone.

Now, let’s talk about the features each card reader offers to help run your business smoothly.

Features and Integrations

When selecting a card reader for your small business, consider features and integrations like inventory management, customer relationship management (CRM), and accounting software compatibility.

Look for a reader that seamlessly integrates with your existing systems to streamline operations and enhance efficiency. This will ensure smooth transactions and easy access to sales data for better decision-making.

Choosing a card machine with advanced features such as real-time reporting, multi-user capabilities, and customisable settings can empower your business to grow. Integration with various payment methods, including contactless payments, chip cards, and mobile wallets, is crucial in meeting the diverse needs of customers while staying ahead in today’s competitive market.

These factors contribute significantly to maximising convenience for both you and your customers.

Security Measures

When choosing a card reader for your small business, security is paramount. Look for machines that comply with the Payment Card Industry Data Security Standard (PCI DSS).

This ensures that customer data is protected from theft or fraud. Additionally, opt for card readers with encryption technology to safeguard each transaction, making it harder for hackers to access sensitive information such as credit card numbers.

Regular software updates are crucial in maintaining a secure system and protecting against new cyber threats.

For extra protection, consider using dual-factor authentication during transactions, adding an extra layer of security by requiring both the card and an additional verification form.

Conclusion

In conclusion, choosing the best card reader for your small business is crucial. Consider factors like price, security, and accepted payment methods. The PakePayments, Worldpay Reader, Zettle by PayPal, Tyl by NatWest, and Square Reader are great options to explore.

These readers offer practical benefits and reliability for efficient transactions. How will you apply these strategies to enhance your business? Remember to prioritise efficiency and simplicity in your approach.

When considering a card reader for your small business, focus on its impact on improving customer experience and increasing sales. Start exploring the best card reader that suits your business needs today!

FAQs

1. What should I look for in the best card reader for my small business?

Look for a card reader that is reliable, easy to use, and compatible with point-of-sale (POS) software. It’s also essential it follows PCI-DSS standards to keep customer data safe.

2. Can a good card reader help me avoid chargebacks?

Choosing a card reader from trusted brands like Verifone or Ingenico can reduce chargebacks by ensuring every transaction is secure and meets the Financial Conduct Authority rules.

3. Do all card readers work with different payment networks and types of cards?

Most top-quality card readers accept networks, including Amex, and suit different ways customers pay, such as checks or cashless options through iPads or other devices.

4. Will I need other equipment besides a card reader to take payments?

Yes, you might need extra gear like printers for receipts, cash drawers if you’re taking cash payments, and POS software to manage sales better.

5. Can I use these card readers with online payment systems on e-commerce platforms?

Many modern card readers are designed to be omnichannel, meaning they’ll work well with your physical shop setup and online payment options on places like Shopify.

Best POS software